NFT Collector's Insights from Rekt-meter

In July of this year, when the world was bracing for a recession and a web3 bear market.

We released a tool that not only changed how people view stats but also how they view the performance of wallets.

The name of this meme-analytics tool is Rekt Meter.

You may ask Gs why such a name.

We will tell you that but just in a moment.

The Rekt Meter allowed degens like you and us to search for any wallet address or ENS name and see how Rekt or Lambo they are.

Rekt means the worst performing wallets and Lambo being the best ones.

Hence the name Rekt Meter.

We have seven categories of wallets overall, Lambo → Milkin it → Up only → Meh → Hurtin → Holding Bags → Full Rekt :)

The funkiness doesn't end just here.

Rekt Meter also shows off data in the form of fun and vibrant analytics like several big macs one can afford with the current portfolio value and the number of hours to wagecuck your way to all-time highs.

Once shared on Twitter in addition to the above perks you can also unveil more stats like Portfolio valuation, ATH, Profit, best and worst performing NFTs, highlight flips, trading stats, and more.

More than 6700 wallets have been searched with 1600+ unique users sharing on Twitter which gave us insights into different kinds of behavior in the NFT collectors space.

We observed some insights by going through the wallets from the best - Lambo, to the worst - Rekt.

But remember that all the data we will discuss down the road is based on the median value of each category of wallets.

(a) When it comes to Ethereum investing in different NFTs our beloved Rekts (worst performing wallet) outspends everyone including the Lambo (Best performing wallet) with a median value of 352 eth which is almost 4.34 times more than Lambo.

In addition to the above mind-boggling figures, the median eth revenue generated by selling NFTs for Lambo is 146 eths which is 1.59 times higher than Rekt wallets.

(b) Investing in new projects seem to be in the blood of our Lambo wallet holders as they are always on the lookout for new NFT collections to be a part of. This makes the Lambo wallets the most frequent minters with 1.43 days between each mint, followed by Rekt wallets with 2.62 days.

But when it comes to volume, Rekt wallets are doing most by minting about 6.43 NFTs per mint seconded by Lambo wallets with 4 NFTs per mint.

(c) Lambo wallets are either more active researchers on upcoming NFT collections or have better access to information regarding the same as these wallets invested 20% of their eth in primary purchases and the rest in secondary NFT purchases. While for Rekt wallets ETH invested is less than 2% for primary purchases.

(Primary purchases are minted directly from the contract and secondary are those that are bought from intermediary markets like Opensea).

(d) Out of the total number of NFTs bought by Rekt wallets, 50% were invested in primary mints and the rest 50% in nfts bought from secondary markets. For Lambo wallets 73% of their nfts was invested as primary mints and the rest 27% bought from secondary marketplaces.

On comparing the avg eth value spent on buying these two types of NFTs, we find out that avg mint price is almost same for Rekt and Lambo wallets however, avg secondary purchase in eth is 2.7 eth for Rekt and 0.6 eth for Lambo telling us that Rekts are buying secondary NFTs for as much as 4.5 times more expensive than Lambo.

The data is indicative that Rekt wallets buying higher value secondary purchases might either be a long term hodl investment or an illiquid investment. Because more projects might be able to jump from 0.6 eth to lets say 2-3 eth than 2.7 eth to say 5-10 eth. This gives Lambo’s investments more positive flipping opportunities compared to Rekt.

(e) Lambo wallets are minting more nfts from contracts than Rekt wallets where the average number of nfts minted is lesser for Lambo wallets than Rekt wallets. Data suggests that Lambo wallets are getting in as much as 3x more collections than Rekt wallets which might be helpful for them to diversify risk. It also reinforces the earlier finding of Lambo wallets being either more active researchers for new projects or having better access to information of the same.

Overall avg number of collections (primary mints + secondary purchases) is also as much as 2x in Lambo as compared to Rekt.

(f) Now let's check out one of the most interesting data compilations that you are going to see for a long time.

So what we have done here is assemble a ratio of:

Total NFTs sold (n) : Floor net worth (Eth) : Eth invested (Eth) to understand how come Rekt wallets are the least profitable ones despite having the second best floor net worth of NFTs after Lambo wallets.

The ratios present themself in this way:

Lambo (best performing wallets) - 1 : 0.2 : 0.5

Milking (second best-performing wallets) - 1: 0.2 :0.4

Rekt (worst performing wallets) - 1 : 0.4 : 6.4

In Newman's terms, the ratio indicates for 1 nft sold, what is the equivalent ratio of eth in floor net worth and total eth invested.

The major observation that we can make from this is that the floor net worth ratio for Rekt wallets is better than milking wallets, still, they are less profitable because the eth invested (and locked in) as NFT is very high which opens the discussion whether Rekt wallets are unprofitable because of buying comparatively high-value secondary NFTs.

Let's look at another ratio which is between the Eth sale value over Eth invested for above three categories of wallets:

Lambo - 1.59

Milkin - 1.51

Rekt - 0.26

Among all seven categories of wallets,

(1) Rekt wallets hold the most number of ENS domains followed by Holding Bag (second last performing wallets)

(2) 70% of NFTs are minted from contracts while 30% are from secondary markets. In addition to this, 20% of the Eth is invested in the mints at an average price of 0.04 eths and the rest 80% are bought from the secondary market at a 3.38 eth average price.

(3) Eth sale revenue : Eth invested is greater than 1 implying that most of the wallets are performing positive in eth.

These were some insights that we learnt and are happy to share with you.

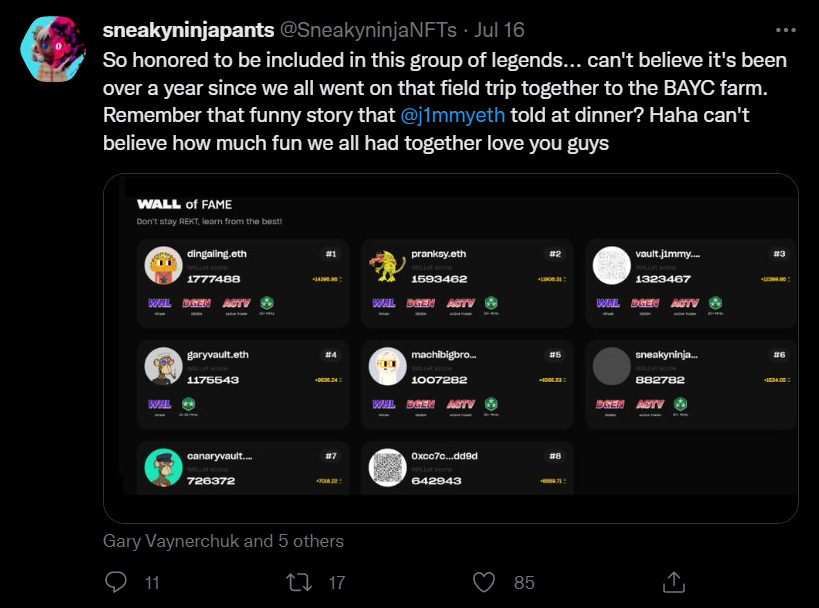

Here is what the community had to say after using Rekt meter

The above exhilarating response from our fellow Web3 degens and OGs proves how much everyone loved the features of Rekt Meter which changed how everyone viewed analytics on blockchain’s open data and the usefulness of wallets stats. It is just the beginning as the degens at Wall are working on some mind-blowing "things" to be released soon. :)

Did you check out the Rekt meter yet?

www.wall.app/rekt-meter